Pros and Cons Of Investing In Mutual Funds in India

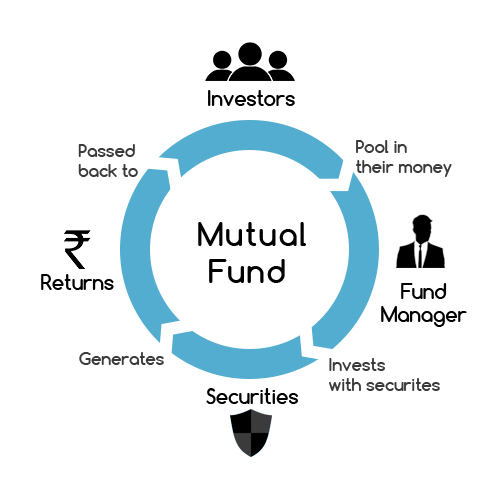

A mutual fund scheme is a form of financial instrument that is created by pooling money from multiple investors. Mutual fund businesses invest their funds in a variety of securities. This enables its investors to increase their wealth through investment. Mutual funds are a higher-risk investment, but the returns are often higher than in any other investment strategy. Mutual funds have both advantages and disadvantages. Let us find out more about them.

Pros Of Mutual Funds In India

- Expert Management: A rookie investor may lack knowledge and information about how and where to invest. Mutual funds are managed and operated by experts. The professionals collect money from investors and invest it in various securities, allowing the investors to profit. The professional keeps a watch on punctual entry and exit and takes care of all the problems. One only needs to invest and rest confident that the rest will be handled by experts in this industry.

- Liquidity: The most significant advantage of investing in a Mutual Fund is the ability to redeem units at any time. Mutual Funds, unlike Fixed Deposits, allow for flexible withdrawals, however, issues such as the pre-exit penalty and exit load must be considered.

- Diversification: Equity mutual funds are risky because their performance is depending on stock market movements. As a result, fund management spreads your investment across equities of companies from diverse industries and sectors, a process is known as diversification. When one asset class underperforms, the other sectors can compensate to save investors from losing money.

- The ability to invest in smaller increments: One of the most essential advantages of mutual funds is their flexibility. Investors need not put up a big amount of money to invest in a Mutual Fund. Investment can be as per the cash flow position. If You earn a monthly salary then you can go for a Systematic Investment Plan (SIP). SIP invests a fixed amount either monthly or quarterly, depending on your budget and convenience.

- Schemes for All Financial Objectives: The best aspect of Mutual Funds is that you can invest as little as Rs. 500. And the maximum might be as high as the investor desires. The only factors to examine before investing in Mutual Funds are their income, fees, risk tolerance, and investment objectives. Therefore, every person from all kinds of backgrounds is allowed to invest in a Mutual Fund irrespective of their income.

- Easy to purchase: Mutual funds are widely available, and you can begin investing and purchasing mutual funds from anywhere in the world. An Asset Management Company (AMC) provides the funds and distributes them through channels. This characteristic makes mutual funds widely available and simple to use. Furthermore, there is no need for a Demat Account to invest in Mutual Funds.

- Transparency and safety: With the implementation of SEBI requirements, all Mutual Fund products have been labeled. This means that every Mutual Fund scheme will be color-coded. This allows an investor to determine the risk level of his investment, making the entire investment process open and safe. This color-coding system employs three different hues to represent different levels of risk- Blue denotes low risk, Yellow denotes medium risk, and brown denotes high risk.

- The shortest lock-in period: Tax Saving Mutual Funds have the shortest lock-in periods of only 3 years. This is lower as opposed to a maximum of 5 years for other tax-saving options like ULIPs, FD, and PPF. On top of that one has the option to keep invested even after the expiration of the lock-in term.

- Automated payments: It is normal for SIPs or investments to be postponed for various reasons. You can choose paperless automation with your fund house or agent by submitting a SIP mandate, which instructs your bank account to deduct SIP amounts when they are due. Email and SMS notifications ensure that you keep on track with your mutual fund investments.

- Tax-efficiency: One can invest in tax-saving mutual funds called ELSS which allows for tax deductions up to Rs 1.5 lakh per annum under Section 80C of the Income Tax Act, 1961. Despite the fact that Long-Term Capital Gains (LTCG) beyond Rs 1 lakh are subject to a 10% tax, they have consistently outperformed other tax-saving products in recent years.

Cons Of Mutual Funds

- Dilution: It is not advisable to invest in too many Mutual Funds at the same time due to dilution. Diversification, however protecting an investor from severe losses, also inhibits one from achieving a higher profit.

- Exit Load: You have exit load as fees levied by AMCs when departing a mutual fund. For a period, it inhibits investors from redeeming their assets. This is similar to the lock-in time used by fund houses to maintain fund stability. It also assists the fund management in raising the necessary funds to purchase suitable securities at the correct price and at the right time.

- The cost of managing the Mutual Fund scheme: Mutual funds are managed and operated by market analysts or fund managers. These Fund Managers work for the fund houses that manage enormous investments every day. This demands a lot of efficiency, skill, and experience in the subject matter.

- Fluctuating Return: Mutual fund returns are not guaranteed as they constantly alter according to market conditions. As a result, before investing, investors should be informed of the fund’s risk profile.

However, it’s important to be aware of the potential downsides. Mutual funds come with expenses and fees that can eat into your returns. Additionally, market risks and fluctuations can impact the performance of the fund. It’s crucial to carefully analyze the fund’s past performance, fund manager’s track record, and associated risks before making any investment decisions. Like this post? Don’t forget to check out our other short stories in our Quick Read section